In the rapidly evolving landscape of digital transactions, consumers and businesses alike seek the perfect balance between security and convenience. While the convenience of quick, hassle-free transactions is essential for customer satisfaction, ensuring the security of sensitive data remains a top priority. One solution that has gained prominence in this quest for equilibrium is Point-to-Point Encryption (P2PE). Let’s explore the concept of P2PE and how it plays a pivotal role in creating seamless customer experiences while safeguarding sensitive information.

The Rise of Digital Transactions

In today’s interconnected world, digital transactions are ubiquitous. From online shopping to mobile banking, we rely on electronic payment methods for everyday activities. As this trend continues to surge, so do concerns about data security. High-profile data breaches and cyberattacks have heightened consumers’ awareness of the importance of protecting their personal and financial information.

Businesses, too, face a daunting challenge: how to provide a frictionless, user-friendly experience while ensuring that customer data remains impenetrable to cybercriminals. Striking this balance is paramount to building trust and sustaining customer loyalty.

Understanding Point-to-Point Encryption (P2PE)

Point-to-Point Encryption, or P2PE, is a robust security measure designed to protect sensitive data throughout the entire transaction process. At its core, P2PE encrypts payment card data from the point of interaction, such as a card swipe or chip insertion, all the way to the payment processor. This ensures that data remains encrypted and unreadable to anyone who may intercept it during transit.

Here’s how P2PE works:Data Encryption: When a customer initiates a payment transaction, the card data is immediately encrypted at the point of interaction. This encryption transforms the data into an unreadable format using advanced encryption algorithms.

- Secure Transmission: The encrypted data is then securely transmitted to the payment processor over a dedicated, encrypted channel. This ensures that even if a hacker intercepts the data, it remains unintelligible.

- Decryption at the Processor: At the payment processor’s end, the encrypted data is decrypted and processed for payment authorization. This process is conducted within a highly secure environment.

- Tokenization: For added security, some P2PE systems replace card data with tokens during the transaction process. Tokens are random, unique identifiers that can be used for subsequent transactions, rendering stolen data useless to attackers.

The Benefits of P2PE

- Robust Data Security

P2PE’s primary advantage is its ability to safeguard sensitive information. By encrypting data at the point of interaction and maintaining that encryption throughout the transaction, the risk of data breaches is significantly reduced. This translates to greater peace of mind for both consumers and businesses.

- Seamless Customer Experiences

While security is paramount, businesses understand that convenience is equally important. P2PE allows for swift, frictionless transactions, ensuring that customers can make purchases or payments without unnecessary delays or complications. This frictionless experience contributes to higher customer satisfaction and loyalty.

- Regulatory Compliance

P2PE is a valuable tool for businesses seeking to comply with data security regulations such as the Payment Card Industry Data Security Standard (PCI DSS). Implementing P2PE can simplify the process of meeting these stringent requirements, potentially reducing compliance costs and the risk of non-compliance penalties.

- Reduced Liability

In the event of a data breach, businesses that have implemented P2PE may benefit from reduced liability. By demonstrating a commitment to data security through encryption, a company can show it took all reasonable steps to protect customer data.

Implementing P2PE: A Strategic Choice

To balance security and convenience effectively, businesses must strategically implement P2PE within their payment systems. Here are some key considerations:

- Selecting the Right Solution: Choosing a P2PE solution that aligns with the needs of your business is critical. Consider factors such as scalability, compatibility with existing systems, and the ability to integrate with emerging technologies.

- Employee Training: Ensure that your staff is well-trained in the proper use of P2PE systems. This includes understanding how to maintain security while delivering a seamless customer experience.

- Regular Updates: Stay vigilant and keep your P2PE systems updated with the latest security protocols and patches. Cybersecurity threats evolve rapidly, so it’s essential to adapt and respond accordingly.

- Customer Education: Educate your customers about the security measures in place, such as P2PE and tokenization. When customers understand the steps you’re taking to protect their data, they’re more likely to trust your business.

For Seamless Customer Experiences: Count on Optimum Payments to Provide You with the Best Payments Solutions for Small Businesses and Enterprises

Optimum Payments stands out as the optimal choice for small businesses seeking the perfect equilibrium between security and convenience through its robust implementation of Point-to-Point Encryption (P2PE). This payment solutions provider has demonstrated a commitment to addressing the specific needs of all sizes of businesses, especially small businesses, while maintaining the highest standards of data security.

With Optimum Payments, small businesses can enjoy the following benefits:

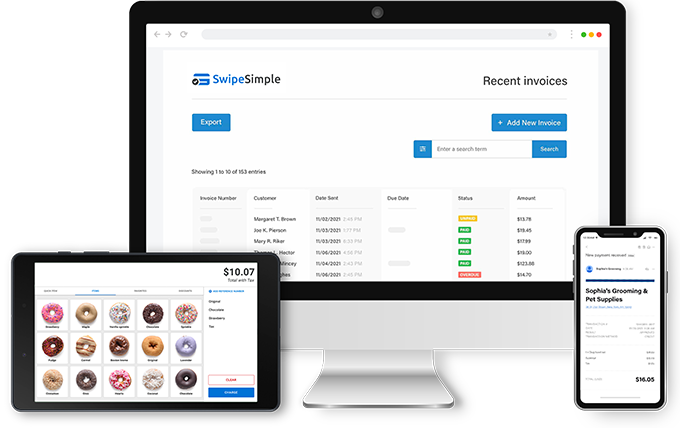

- Tailored Solutions: Optimum Payments recognizes that small businesses have unique requirements. They offer flexible and scalable payment solutions, such as products and services, that can fit the size and nature of the business, ensuring that security measures are neither excessive nor lacking.

- P2PE Expertise: Optimum Payments is at the forefront of P2PE technology. By implementing this encryption method, they offer small businesses a robust defense against data breaches, safeguarding sensitive customer information from the point of interaction throughout the entire transaction process.

- User-Friendly Experience: While security is paramount, Optimum Payments doesn’t compromise on user experience. They understand the importance of providing small business owners with a convenient, easy-to-use payment platform that ensures swift transactions and minimizes disruptions.

- Compliance Assurance: Small businesses often grapple with regulatory requirements. Optimum Payments’ P2PE solutions help small businesses achieve and maintain PCI-compliance and other relevant industry standards, reducing the burden of regulatory compliance.

- Cost-Effective Options: Optimum Payments offers cost-effective pricing models that cater to the budget requirements and constraints of small businesses. They understand the importance of keeping overheads low while still delivering top-tier payment security.

Conclusion

Balancing security and convenience in the realm of digital transactions is an ongoing challenge, but it’s one that Point-to-Point Encryption (P2PE) addresses admirably. By encrypting data at the point of interaction and maintaining that security throughout the transaction process, P2PE ensures that sensitive information remains out of reach for cybercriminals. Simultaneously, it allows businesses to provide a seamless, frictionless customer experience, bolstering trust and loyalty.

In an era where data breaches and cyberattacks are prevalent, P2PE is not merely a security measure but a strategic choice for businesses committed to safeguarding customer data and delivering exceptional experiences. The adoption of P2PE will likely become increasingly essential for businesses seeking to survive and thrive in the digital age.

Optimum Payments stands as the best payment solutions provider for small businesses seeking to strike the perfect balance between security and convenience. Their expertise in P2PE, commitment to customization, user-friendly approach, and cost-effective options make them an ideal choice for businesses of all sizes. Contact Optimum Payments, and have the confidence in the security of their transactions while delivering a seamless payment experience to your customers.